The Greatest Guide To Debt Collection Agency

Wiki Article

An Unbiased View of Personal Debt Collection

Table of ContentsPersonal Debt Collection Can Be Fun For AnyoneExamine This Report on International Debt CollectionExamine This Report about Dental Debt CollectionInternational Debt Collection - Questions

The debt buyer acquires only a digital data of info, often without sustaining evidence of the financial debt. The financial obligation is also normally older financial obligation, often described as "zombie debt" due to the fact that the financial obligation customer attempts to revive a financial debt that was beyond the statute of limitations for collections. Debt debt collection agency may contact you either in writing or by phone.

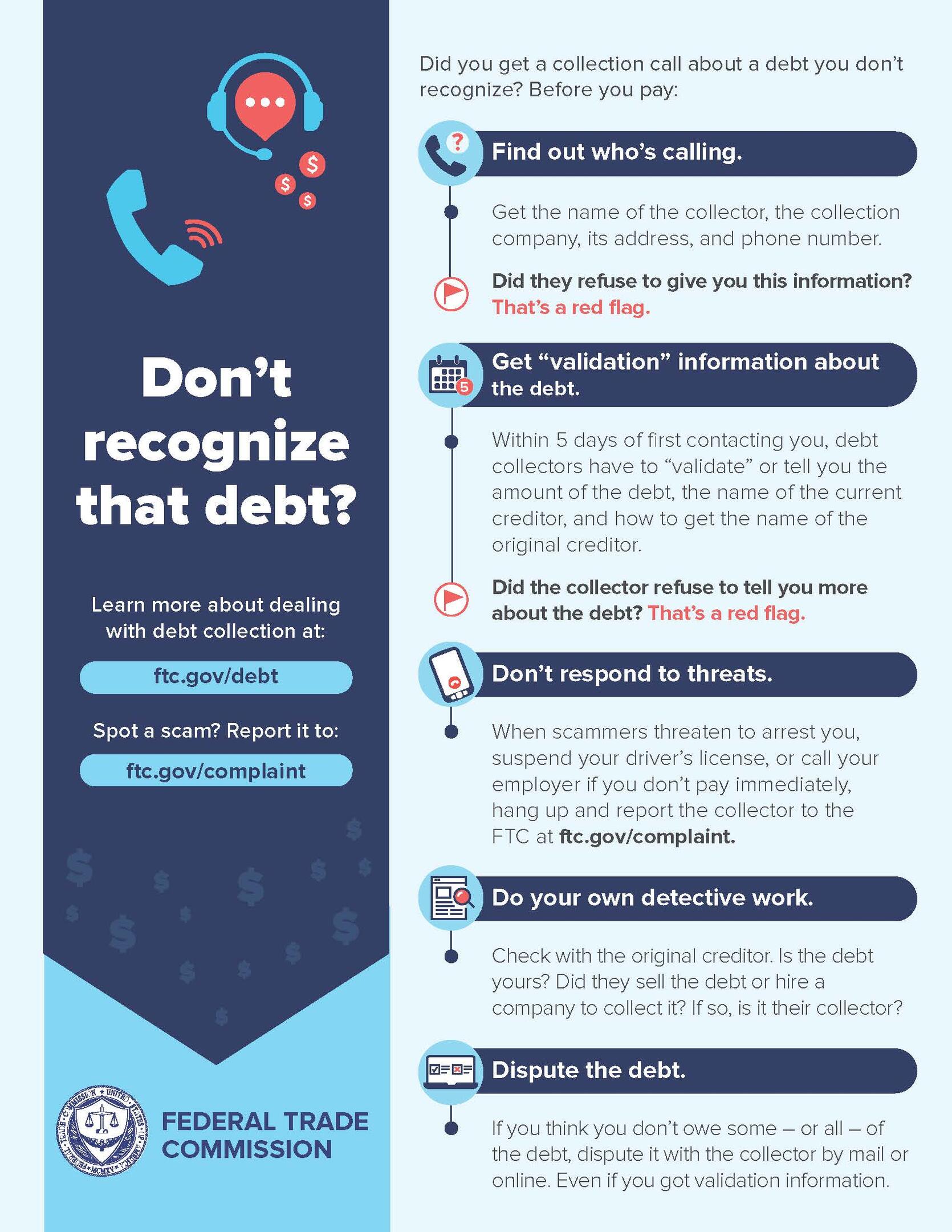

But not speaking with them will not make the financial obligation vanish, as well as they might just try different methods to call you, consisting of suing you. When a debt collection agency calls you, it is necessary to obtain some preliminary information from them, such as: The debt collection agency's name, address, and telephone number. The total quantity of the financial debt they claim you owe, consisting of any type of charges as well as rate of interest charges that might have accumulated.

Dental Debt Collection - An Overview

The letter needs to mention that it's from a debt collection agency. They should also inform you of your legal rights in the debt collection procedure, as well as exactly how you can contest the financial debt.If you do contest the debt within thirty days, they should cease collection initiatives until they offer you with evidence that the financial obligation is your own. They should supply you with the name and address of the original financial institution if you request that info within thirty days. The financial debt validation notice need to include a type that can be used to call them if you desire to dispute the debt.

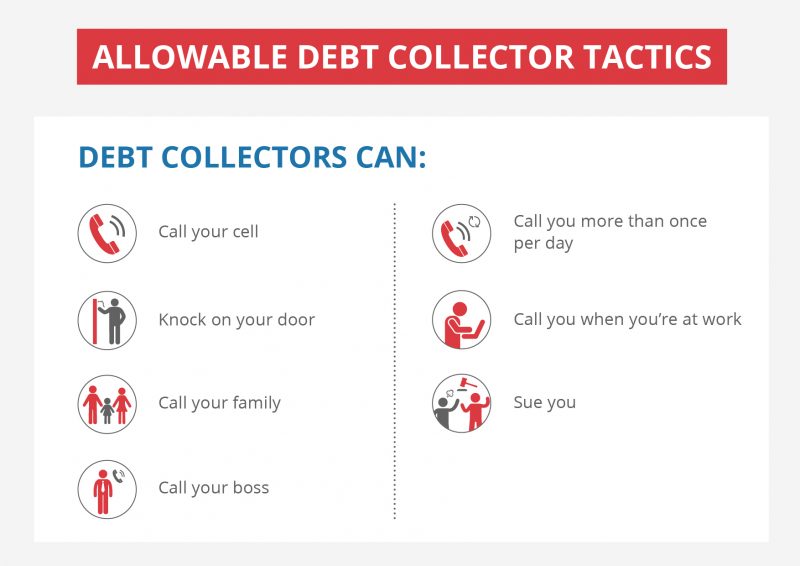

Some things financial obligation enthusiasts can not do are: Make repeated calls to a debtor, intending to frustrate the debtor. Normally, unsettled financial debt is reported to the credit bureaus when it's 30 days past due.

If your debt is transferred to a financial obligation collection agency or offered to a financial debt customer, an access will certainly be made on your credit history record. Each time your financial debt is sold, if it continues to go unpaid, one more access will certainly be added to your credit score record. Each adverse access on your debt record can continue to be there for up to seven years, also after the financial debt has actually been paid.

Indicators on Private Schools Debt Collection You Need To Know

What should you expect from a collection company as well visit homepage as just how does the procedure job? Continue reading to locate out. When you have actually made the choice to employ a debt collector, make certain you select the best one. If you comply with the advice listed below, you can be certain that you have actually hired a reliable agency that will handle your account with treatment.As an example, some are better at obtaining results from bigger organizations, while others are proficient at collecting from home-based companies. Make certain you're dealing with a company that will really serve your needs. This may seem obvious, but before you employ a collection firm, you require to make sure that they are qualified as well as licensed to work as financial debt enthusiasts.

Before you begin your search, recognize the licensing needs for debt collection agency in your state. That means, when you are talking to companies, you can speak intelligently concerning your state's demands. Talk to the firms you consult with to guarantee they fulfill the licensing demands for your state, specifically if they are located in other places.

You ought to additionally consult your Bbb as well as the Business Collection Agency Organization for the names of respectable and also highly related to financial obligation collection agencies. While you may be passing along these financial debts to a collector, they read are still representing your business. You need to recognize just how they will certainly represent you, exactly how they will certainly function with you, and also what appropriate experience they have.

Private Schools Debt Collection Can Be Fun For Anyone

Even if a strategy is lawful doesn't mean that it's something you want your company name connected with. A respectable debt collection agency will certainly function with you to set out a plan you can cope with, one that treats your previous customers the method you view website 'd intend to be treated as well as still finishes the job.If that occurs, one strategy many firms utilize is skip tracing. You need to likewise dig into the enthusiast's experience. Pertinent experience raises the probability that their collection efforts will be effective.

You should have a point of call that you can communicate with and also get updates from. Business Debt Collection. They should have the ability to plainly articulate what will certainly be gotten out of you in the process, what info you'll need to offer, as well as what the cadence and also activates for interaction will be. Your chosen company must be able to suit your chosen interaction requirements, not force you to approve theirs

No matter of whether you win such a situation or not, you wish to be sure that your firm is not the one responsible. Ask for proof of insurance from any type of debt collector to shield yourself. This is usually called a mistakes and omissions insurance coverage policy. Financial debt collection is a service, and it's not an economical one.

Report this wiki page